How Touchless Invoice Processing System Transforms Travel Business Operations

Automating backend processes has become essential as the travel industry embraces digital transformation. A touchless or automated invoice processing system is one of the most impactful upgrades a travel agency can implement. By eliminating manual entry and paperwork, travel businesses can significantly enhance accuracy, efficiency, and client satisfaction.

What is an Automated Invoice Processing System?

Imagine invoices arriving at your travel agency and almost magically processing themselves. That’s the idea behind touchless invoice processing. In simple terms, it’s an advanced method where invoices are handled with minimal to zero human interaction from the moment they are received until they are ready for payment or reconciliation. This is achieved through the use of an automated invoice processing system.

Traditionally, invoice processing involves many manual steps:

- Receiving: Invoices arrive by mail, email, or even fax.

- Opening & Sorting: Someone opens, sorts, and possibly scans them.

- Data Entry: Information from the invoice (vendor name, amount, date, services, client details, booking codes) is manually entered into your accounting or booking system, which is a common source of errors.

- Verification & Matching: The invoice data is checked against purchase orders, booking records, and receipts. This often involves cross-referencing multiple systems.

- Approval: The invoice needs to be approved by the right person or department. This can involve physical signatures or email approvals.

- Payment: The invoice is then scheduled for payment.

- Filing: Physical or digital copies are filed away.

Each of these steps takes time and can lead to mistakes. A touchless automated invoice processing system uses innovative technology to skip most or all of these manual steps. It brings together technologies like:

- Optical Character Recognition (OCR): This technology reads text from scanned images or PDFs, turning it into usable digital data.

- Artificial Intelligence (AI) and Machine Learning (ML): These help the system learn from past invoices, recognize patterns, and make smart decisions, such as automatically classifying invoices or flagging potential issues.

- Automated Workflows: Rules are set up to guide the invoice through the necessary steps (matching, approval) without human intervention or only stepping in when a problem arises.

- Integration: The system connects seamlessly with your existing travel agency management software, accounting software, and payment systems.

The goal is to move from a human-heavy process to a largely automated one, which will lead to massive gains in efficiency, accuracy, and control.

Why Travel Businesses Need an Automated Invoice Processing System Now More Than Ever

The travel industry faces unique challenges that make an automated invoice processing system particularly beneficial:

- High Volume of Transactions: Travel agencies deal with countless small and large transactions daily—flights, hotels, tours, transfers, commissions, and refunds—each creating an invoice.

- Complex Invoices: Travel invoices can be very detailed, including multiple service lines, different currencies, taxes, and unique booking codes.

- Multiple Vendors: Agencies work with hundreds, even thousands, of airlines, hotels, tour operators, and ground transport providers, each with their invoice format.

- Tight Margins: Travel agencies often operate on slim profit margins, so every bit of efficiency and cost-saving matters.

- Seasonal Fluctuations: Business volume can change dramatically with seasons, making it hard to staff manual invoice processing correctly.

- Compliance and Reporting: Strict financial regulations and accurate reporting (e.g., for IATA, ASTA, or local tax authorities like NBR in Bangladesh) require precise record-keeping.

Top 7 Ways Automated Invoice Processing Systems Transform Travel Business Operations

For travel agencies in Bangladesh, adopting an automated invoice processing system like the one IV Trip can integrate with offers a multitude of transformative benefits:

-

Significant Cost Reduction:

- Reduced manual labor: Automating data entry and processing significantly reduces the need for manual intervention, freeing up valuable staff time for more strategic tasks. You can optimize your workforce and potentially avoid hiring additional administrative personnel solely for invoice management.

- Elimination of paper costs: Moving to a paperless system eliminates expenses associated with printing, storing, and managing physical documents. This includes the cost of paper, ink, filing cabinets, and office space dedicated to storage.

- Early payment discounts: Faster processing and payment cycles enable you to take advantage of early payment discounts offered by vendors, further reducing costs.

-

Enhanced Efficiency and Productivity:

- Faster processing cycles: Automation drastically reduces the time it takes to process invoices from days or weeks to hours or even minutes, accelerating your entire financial workflow.

- Improved staff productivity: By automating repetitive tasks, your finance team can focus on higher-value activities such as financial analysis, budgeting, and strategic planning, boosting overall productivity and job satisfaction.

- Reduced errors: Automated data capture and matching minimize human errors associated with manual data entry and comparisons, leading to more accurate financial records and fewer reconciliation issues.

-

Streamlined Workflows and Approvals:

- Customizable approval workflows: You can define specific approval hierarchies based on invoice amounts, departments, or vendor types, ensuring invoices are routed to the right people for timely review and authorization.

- Faster approval cycles: Electronic routing and notifications expedite the approval process, eliminating bottlenecks and ensuring timely payments.

- Improved communication and collaboration: Electronic workflows provide a clear audit trail and facilitate communication between relevant stakeholders regarding invoice status and approvals.

-

Greater Visibility and Control:

- Real-time invoice tracking: You gain complete visibility into the status of every invoice in the system, from receipt to payment. You can easily identify bottlenecks and proactively address potential issues.

- Comprehensive reporting and analytics: Automated invoice processing systems provide detailed reports and dashboards that provide valuable insights into your spending patterns, vendor performance, and payment history. This data empowers you to make informed financial decisions.

- Improved forecasting and budgeting: A clear overview of your payables can improve your cash flow forecasting and budgeting accuracy.

-

Strengthened Vendor Relationships:

- Timely payments: Efficient processing and electronic payments ensure that your vendors are paid on time, fostering stronger and more reliable relationships.

- Reduced payment disputes: Accurate matching and clear communication minimize discrepancies and payment disputes, leading to smoother vendor interactions.

- Improved transparency: Providing vendors with clear payment statuses and timelines enhances transparency and builds trust.

-

Enhanced Security and Compliance:

- Secure digital storage: Electronic invoices are stored securely in a centralized digital repository, reducing the risk of loss, damage, or unauthorized access associated with paper documents.

- Audit trails: Automated invoice processing systems maintain a detailed audit trail of every action taken on an invoice, ensuring transparency and facilitating compliance with accounting regulations.

- Reduced fraud risk: Automated controls and approval workflows can help detect and prevent fraudulent invoice activities.

-

Scalability for Growth:

- Handles increasing invoice volumes: As your travel business expands, an automated invoice processing system can easily hold a growing volume of invoices without requiring significant staff or manual effort increases.

- Supports business expansion: Automation’s efficiency gains provide a solid foundation for scaling operations and pursuing new growth opportunities.

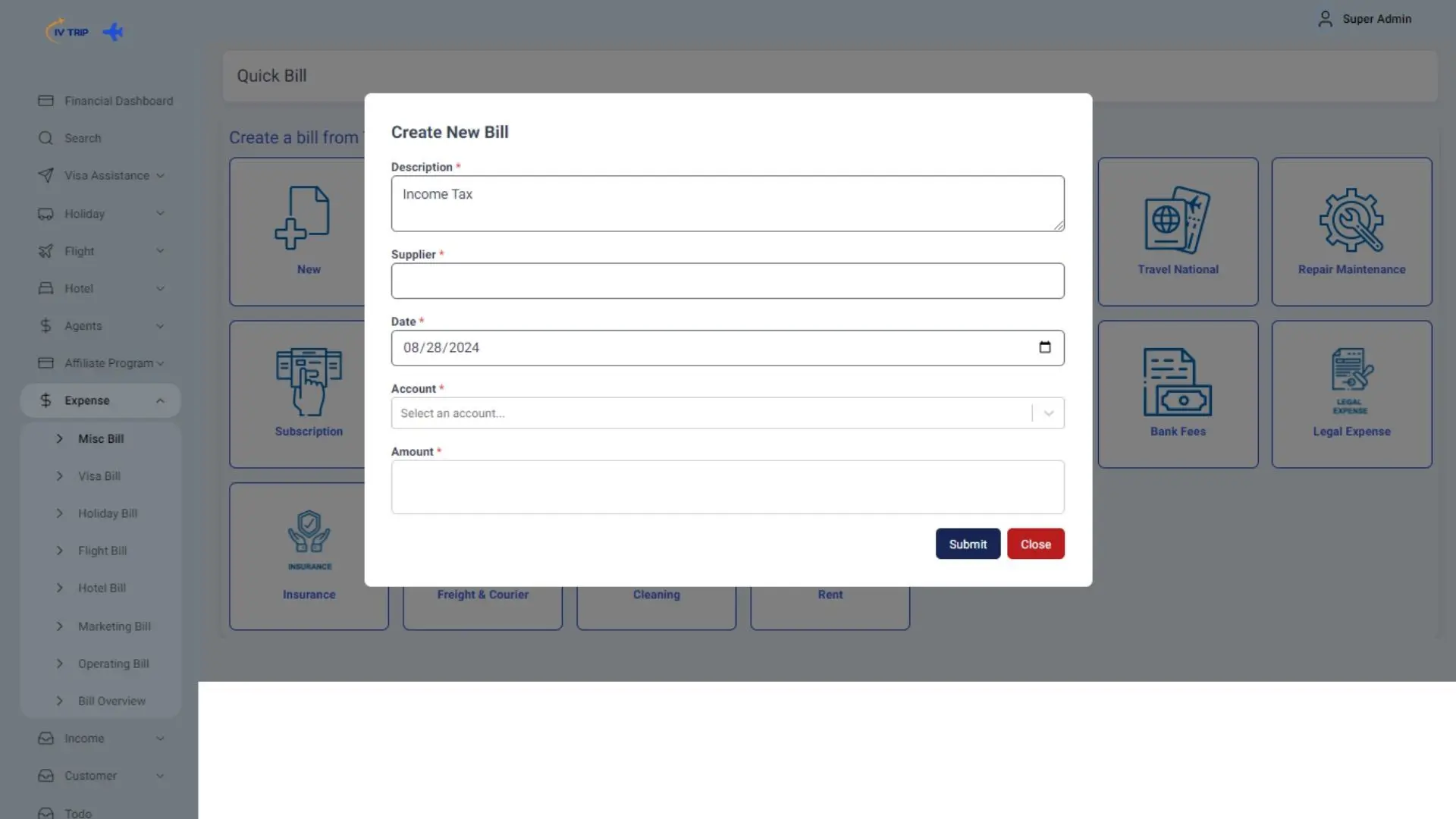

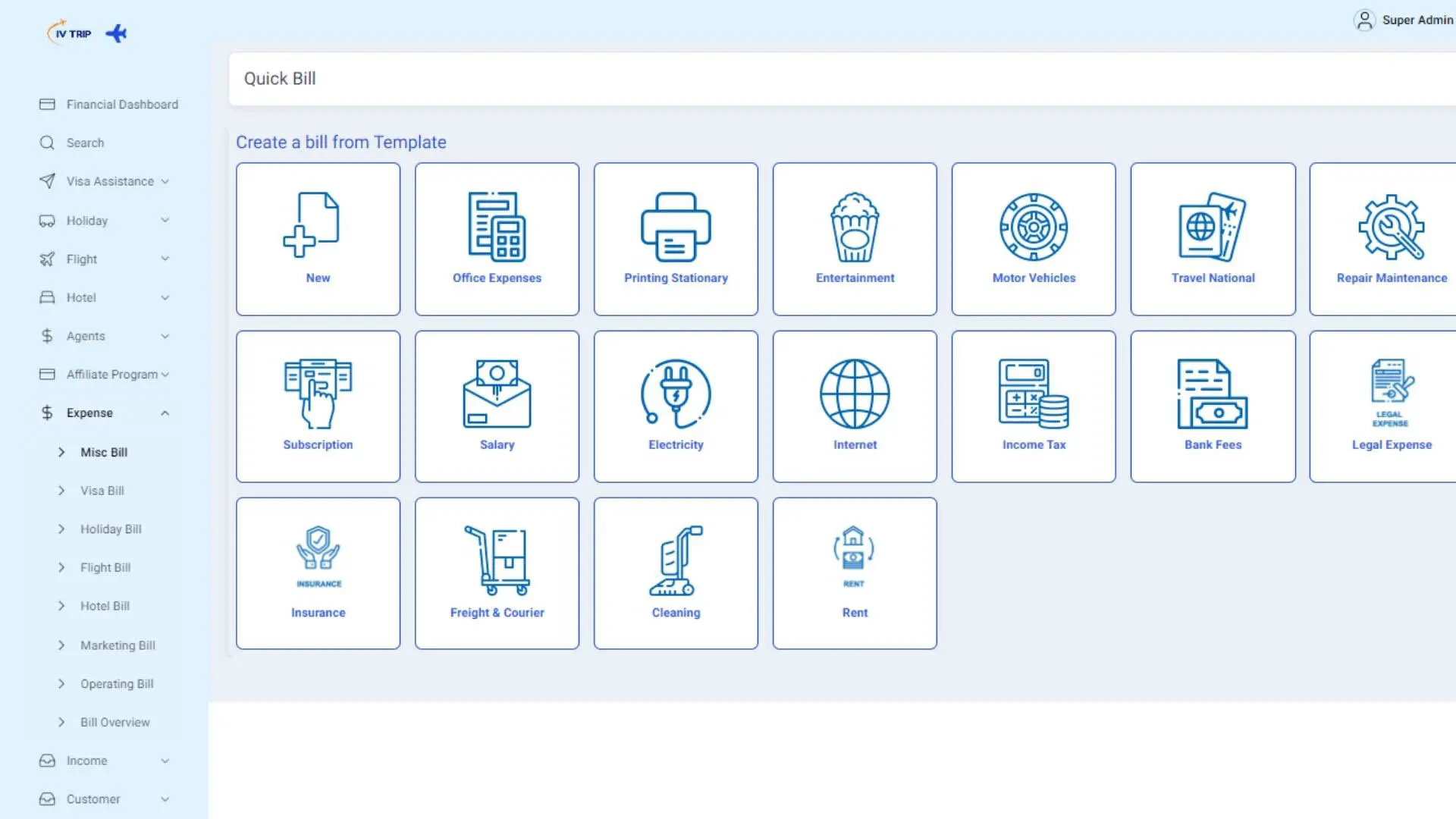

IV Trip: Your Partner for Automated Invoice Processing System in Bangladesh

At IV Trip, we’re not just selling software; we’re providing solutions that empower travel agencies in Bangladesh to thrive. Our specialized travel agency software solutions often include or integrate with robust automated invoice processing system capabilities explicitly designed for the complexities of the travel industry.

Here’s why partnering with IV Trip for your touchless invoice processing needs makes sense:

-

Deep Travel Industry Knowledge: We understand the unique challenges of airlines, hotels, tour operators, and the specific data points crucial for travel invoices in Bangladesh.

-

Tailored Solutions: We don’t believe in one-size-fits-all. Our solutions are designed to fit your agency’s specific workflows and requirements.

-

Seamless Integration: Our systems are built to integrate smoothly with common GDS platforms, accounting software, and banking systems prevalent in Bangladesh.

-

Local Support and Expertise: Being based in Bangladesh, we offer prompt, culturally aware support and understand the local regulatory environment, making implementation and ongoing use much smoother.

-

Proven Track Record: We have a history of helping Bangladeshi travel agencies achieve greater efficiency and profitability.

-

Future-Ready Technology: We continuously update our software to incorporate the latest AI, machine learning, and automation advancements.

By freeing travel agencies from the burden of manual invoice processing, we enable them to focus on creating unforgettable travel experiences and growing their business.

The Future is Touchless: Embrace the Automated Invoice Processing System

The travel industry is constantly evolving, and staying ahead means embracing innovation. Manual invoice processing is a relic of the past, holding back efficiency, draining resources, and increasing the risk of errors. Touchless invoice processing, powered by an innovative, automated system, is the clear path forward.

By adopting this technology, travel agencies in Bangladesh and beyond can:

- Boost operational speed and throughput.

- Achieve near-perfect accuracy in financial data.

- Realize significant cost savings.

- Ensure robust compliance and simplify audits.

- Gain powerful insights for strategic decision-making.

- Empower their employees to do more meaningful work.

Don’t let outdated processes hinder your travel business’s growth. Embrace the future of financial management with an automated invoice processing system. It’s not just about managing invoices; it’s about transforming your entire operation for greater success and profitability.

Frequently Asked Questions (FAQs)

What does “automated invoice processing system” mean for a travel agency?

Touchless invoice processing means handling invoices with very little to no human involvement. An automated invoice processing system uses technology like OCR and AI to automatically capture, validate, match, and even approve invoices, minimizing manual steps for travel agencies

How does an automated invoice processing system save money for travel businesses?

It reduces the need for manual data entry, cuts down on paper and storage costs, prevents costly errors like duplicate payments, and allows staff to focus on more productive tasks. These savings quickly add up for any travel business.

Is an automated invoice processing system secure for sensitive financial data?

Yes, reputable automated invoice processing system providers like IV Trip prioritize security. They use encryption, secure cloud storage, and access controls to protect sensitive financial data. Digital records often offer better protection than physical paper trails.

How does OCR help in touchless invoice processing for travel?

OCR (Optical Character Recognition) technology is vital. It “reads” information from scanned or digital invoices (like PDF invoices from airlines or hotels) and converts it into usable, editable data. This eliminates manual data entry, a significant source of errors in travel invoice processing.

Can an automated invoice processing system integrate with my existing travel agency software and accounting tools?

Absolutely. Strong integration is key for true touchless processing. A good automated invoice processing system should connect seamlessly with your travel agency management software, GDS (Global Distribution System), and accounting software (like Tally or QuickBooks) to ensure data flows smoothly.

What if an invoice has a mistake or doesn’t match a booking?

An automated invoice processing system is designed to flag discrepancies. If an invoice amount doesn’t match a booking or key information is missing, the system will hold it and alert the relevant staff member for manual review and correction, ensuring accuracy.

How long does implementing an automated invoice processing system take?

The implementation time varies depending on the complexity of your agency’s operations, the volume of invoices, and the level of customization and integration needed. It can range from a few weeks for simpler setups to several months for larger, more complex travel agencies.

Will touchless processing replace my accounting staff?

The goal of an automated invoice processing system is not to replace staff but to free them from repetitive, low-value tasks. Your accounting team can then focus on more strategic financial analysis, vendor negotiations, auditing, and other high-impact activities.

Is this technology suitable for small travel agencies in Bangladesh?

Yes, definitely. While large agencies benefit from handling huge volumes, even small and medium-sized travel agencies in Bangladesh can significantly improve efficiency, cost savings, and accuracy by adopting an automated invoice processing system—the benefits scale with your business size.

How does IV Trip help travel agencies in Bangladesh with automated invoice processing?

IV Trip specializes in providing travel agency software solutions that include robust automated invoice processing system features or integrate seamlessly with leading solutions. We understand the unique needs of the Bangladesh travel market, offering tailored systems, local support, and expertise to ensure successful implementation and adoption.

Touchless invoice processing is no longer a luxury—it’s a necessity for modern travel businesses in Bangladesh and beyond. The benefits are undeniable, from operational efficiency to improved client trust. By integrating an automated invoice processing system, travel companies can streamline operations and future-proof their growth.

Ready to eliminate invoice headaches? Contact and try IV Trip’s travel agency software solution today and experience smarter travel operations!