Top 5 Reasons Why Travel Businesses Need Travel Accounting Software

Top 5 Reasons Why Travel Businesses Need Travel Accounting Software

As the travel industry grows increasingly competitive and complex, agencies must evolve beyond traditional practices to remain efficient and profitable. Whether you’re managing domestic travel or handling international tour packages, one element remains at the core of every operation: accurate financial management.

At IV Trip, we understand the challenges travel agencies face—especially in regions like Bangladesh, where business models are becoming more digital, clients are more demanding, and accounting is more intricate. The need for travel accounting software has never been greater.

In this article, we’ll outline the top five reasons your travel business should consider implementing dedicated accounting software and how this move can streamline operations, ensure compliance, and improve profitability.

Reasons Why Travel Businesses Need Travel Accounting Software

-

Automates Complex and Time-Consuming Financial Tasks

Managing travel finances isn’t like managing a regular retail or service business. A single booking may involve multiple vendors, partial payments, commissions, cancellations, and refunds. Attempting to handle this manually often leads to the following:

- Time-consuming data entry

- Errors in calculations or reconciliations

- Difficulty tracking individual transactions

- Inefficient invoice generation

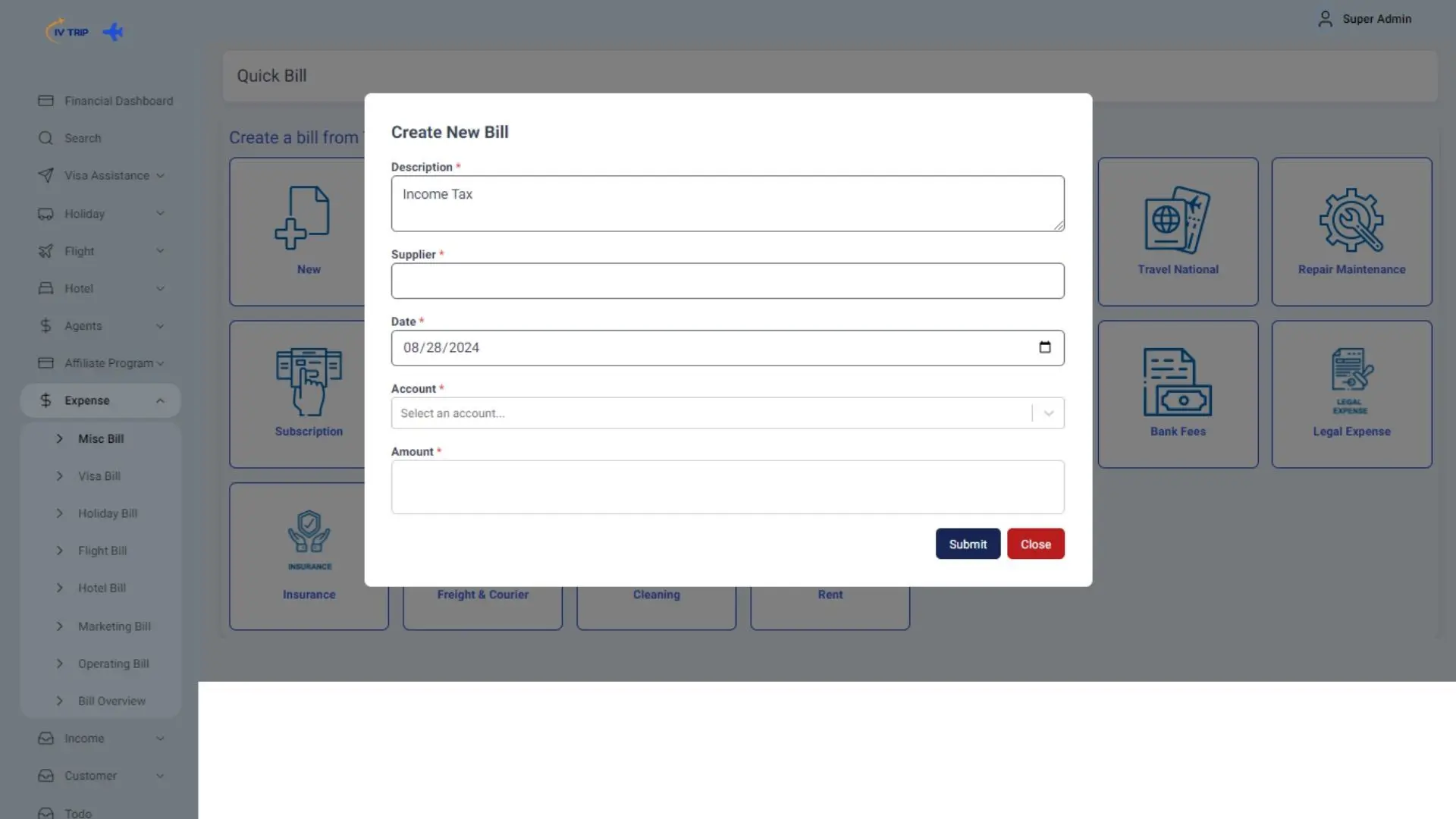

With travel accounting software, your agency can automate many of these processes. For example, transactions from booking systems can automatically be logged into the accounting platform, eliminating the need for duplicate entries. Vendor payments, customer invoices, and agent commissions can all be processed with predefined rules, saving significant time while minimizing errors.

-

Provides Real-Time Visibility and Financial Insights

One of the most significant limitations of using spreadsheets or general accounting software is the lack of real-time reporting. Travel businesses need to make quick decisions based on accurate data—especially when it comes to managing working capital and allocating budgets.

Specialized travel accounting software gives you access to real-time dashboards that display:

- Revenue generated from different service categories

- Agent-wise or branch-wise performance metrics

- Upcoming payable and receivable amounts

- Profit and loss summaries by booking, Trip, or period

These features give business owners the financial clarity they need to make proactive decisions, whether it’s adjusting pricing, cutting costs, or investing in marketing during peak seasons.

-

Simplifies Tax Compliance and Regulatory Reporting

For any travel business in Bangladesh, staying compliant with local tax laws—including VAT, TDS, and service taxes—is a constant responsibility. However, manually calculating and filing taxes for hundreds of bookings each month is not only inefficient but also risky.

Travel accounting software simplifies tax management by:

- Automatically applying VAT or service charges during invoice creation

- Generating audit-ready financial reports for local compliance

- Maintaining transaction history for future reference or inspections

- Offering one-click export features for submission to tax authorities

With changing regulations and a growing emphasis on digital tax systems, travel agencies that embrace automation are far more likely to avoid penalties and maintain long-term sustainability.

![]()

-

Enables Seamless Integration Across Your Travel Business

A significant pain point for travel agencies is the disconnection between different departments—sales, operations, accounts, and management often use separate tools, which leads to data silos, miscommunication, and inefficiency.

Modern travel agency software platforms like IV Trip solve this by providing full integration across the following:

- Booking engines and accounting modules

- Customer relationship management (CRM) and invoicing

- Expense management and payment reconciliation

- Staff performance and incentive tracking

When data flows automatically between departments, agencies benefit from unified records, consistent reporting, and smoother workflows—making it easier to manage everything from a single dashboard.

-

Supports Business Scalability and Growth

Whether you’re a startup agency or a growing tour operator, scalability is essential. As your business expands into new locations or markets, your accounting system must keep pace. Traditional methods often buckle under this pressure, leading to delays, bottlenecks, or financial discrepancies.

Here’s how travel accounting software supports growth:

- Manages multiple branches or departments with consolidated financial reporting

- Handles multi-currency transactions for international bookings

- Offers customizable reports for decision-making and performance analysis

- Allows role-based access control to streamline responsibilities across teams

By building your financial operations on a scalable system, you position your agency to grow with confidence and avoid the hidden costs of unstructured expansion.

What Features Should You Look for in Travel Accounting Software?

Not all accounting tools are built for the travel industry. When selecting a solution, ensure it includes:

- Integration with your existing booking and CRM tools

- Automated vendor and agent commission management

- Real-time reporting with customizable dashboards

- Tax compliance support tailored to Bangladesh’s regulations

- Cloud-based access for remote financial management

- Role-based user permissions and data security controls

IV Trip’s travel accounting solution offers all of these features and more, designed specifically for travel agencies in Bangladesh and beyond.

Why Is This Especially Important for the Travel Business in Bangladesh?

The travel business in Bangladesh is growing rapidly, driven by rising incomes, increasing internet penetration, and growing interest in both domestic and international tourism. However, many small and mid-sized agencies still rely on outdated methods to manage their finances.

This creates significant challenges, including:

- Inaccurate cash flow management

- Delayed payments to suppliers or agents

- Lack of transparency in financial records

- Difficulty scaling operations efficiently

With government emphasis on digital transformation and the travel sector becoming more competitive, adopting modern tools like travel accounting software for Bangladesh is no longer optional—it’s essential for long-term growth and compliance.

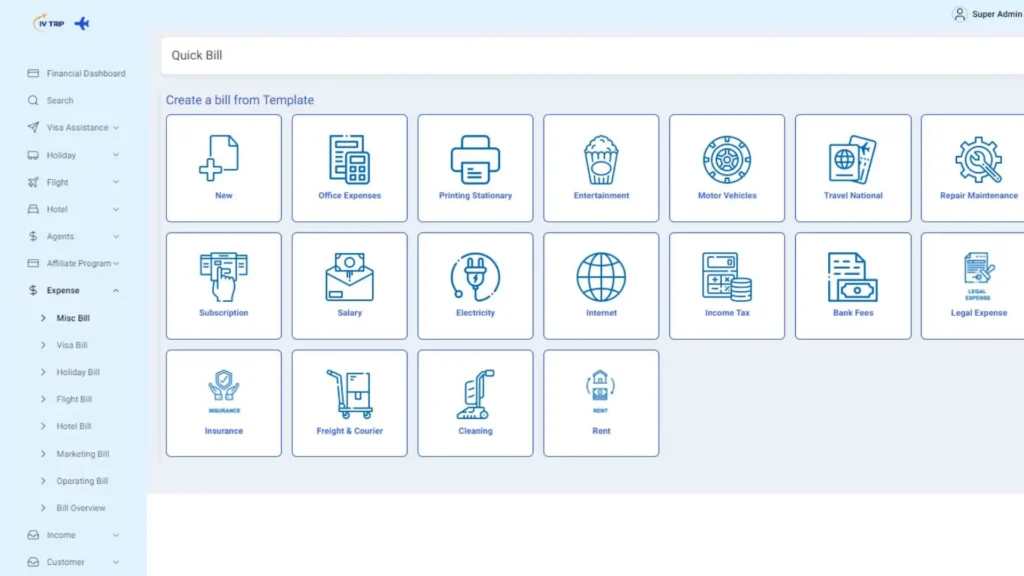

Key Features of IV Trip’s Travel Accounting Software

IV Trip is a robust, cloud-based accounting solution built specifically for businesses in the travel industry. Unlike generic accounting tools, it is designed to handle the unique challenges travel agencies face—such as managing complex bookings, commission structures, and multi-currency transactions.

In a sector where nearly 40% of travel businesses report difficulties with financial processes like invoicing and payments, IV Trip offers a reliable, streamlined solution. Its powerful features go beyond basic bookkeeping to support operations like managing purchase orders, handling multiple companies, and coordinating teams across different locations.

What makes IV Trip stand out is its ability to unify critical processes. It seamlessly integrates reservations, invoicing, and commission tracking into one platform—an essential feature, especially since 70% of travel agencies struggle with commission management. With IV Trip, businesses can automate the calculation and sharing of commissions across agents, reducing disputes and saving time.

Core Functionalities at a Glance

- A modern, user-friendly dashboard that simplifies daily accounting activities

- Intuitive interface for easy navigation, even for non-accounting users

- Comprehensive features that support a wide range of accounting needs

- Seamless integration with popular travel systems and booking engines via API

- Real-time access to financial data for better business decisions

- Operates online and offline, with full support for web-based back-office systems

- Full support for multi-service bookings, including flights, hotels, transfers, car rentals, cruises, and packages

- Built-in handling of ARC/BSP, PLB, taxation, and currency conversion

- Complete Accounts Payable (AP) and Accounts Receivable (AR) management, including partial payments

- Easy reporting options with export to PDF or Excel and direct emailing

- Allows separate billing for different services or product categories

- Support for single or multi-company setups

- Customizable document series for invoices, receipts, and credit notes

- Built-in audit logs to track all financial and transactional changes

- Automated calculations for fares, tariffs, and charges during invoicing

- Full transaction tracking for smoother financial operations

With these capabilities, IV Trip empowers travel agencies in Bangladesh and beyond to manage their finances with greater accuracy, control, and efficiency. It’s not just an accounting tool—it’s a complete financial management system tailored for the travel industry.

Frequently Asked Questions (FAQs)

- What is travel accounting software?

It is a specialized accounting system built for travel agencies. It is designed to handle bookings, commissions, vendor payments, refunds, and taxation in one platform.

- Can general accounting software work for travel businesses?

General software lacks the specific features needed to manage bookings, multi-party transactions, and travel-related tax calculations, making it inefficient for this industry.

- Is travel accounting software suitable for small agencies?

Yes. Scalable platforms like IV Trip offer solutions for agencies of all sizes, including startups and SMEs.

- How does it help with tax compliance in Bangladesh?

The software can calculate and apply VAT, generate NBR-compliant reports, and maintain audit trails to simplify filing and avoid errors.

- Will it integrate with my existing travel software?

Most modern systems, including IV Trip, are built to integrate with major booking engines, GDS platforms, and CRMs.

- Is it accessible remotely?

Yes. Cloud-based travel accounting software can be accessed securely from anywhere, enabling remote financial management.

- How does it support business growth?

It offers features like multi-branch support, multi-currency handling, and advanced analytics, helping your agency scale efficiently.

- Can I manage commissions and vendor payments automatically?

Yes. The software can auto-calculate commissions and track pending or completed vendor payments based on booking data.

- How secure is travel accounting software?

Most platforms provide role-based access, data encryption, and secure cloud hosting to protect sensitive financial data.

- How do I get started with IV Trip?

You can request a demo or contact our team directly to explore packages that suit your agency’s size and requirements.

In today’s fast-moving travel industry, relying on outdated accounting processes puts your business at a disadvantage. Whether you’re focused on managing complex transactions, staying compliant with tax laws, or scaling your operations, investing in travel accounting software is a strategic decision that delivers long-term benefits.

IV Trip is proud to support travel businesses across Bangladesh with advanced software solutions tailored to the industry’s unique needs. We help agencies streamline finances, reduce errors, and operate with complete visibility—so you can focus on growing your business.

Ready to take your travel business to the next level?

Contact IV Trip today to schedule a free demo and see how our travel accounting software can help your agency become more efficient, accurate, and profitable.