Best Accounting Software for Travel Agency in Bangladesh

A travel agency’s affairs can be complex, especially when it comes to managing its finances. An abundance of operations, numerous revenues, and a lot of expenses make effective accounting a top priority. This is why adequately designed accounting software for travel agency is not a luxury but a necessity.

We comprehended it during the IV trip to Dhaka, Bangladesh. Because of this, we have developed a complete package of accounting software for travel agency with specific functions for you.

Why Do We Need Accounting Software for Travel Agency

Travel agencies are involved in many financial dealings, including collecting booking fees and commissions, accepting payments from customers, and issuing refunds. Traditional methods of accounting include relaying and recording information manually, which is tiresome and error-prone. All these challenges can be easily overcome by using appropriate software, especially accounting software for travel agency. Accounting is enhanced by the dedicated features that allow our software to streamline their operations, increase efficiency, and reduce errors.

Benefits of Using Accounting Software for Travel Agency

- Increased Efficiency

Accounting software for travel agency contributes significantly to functional capacity since it relieves tedious tasks from accounts. This removes the burden of performing a lot of manual financial management from your team, allowing them to focus on other business-critical tasks.

- Enhanced Accuracy

The use of automation decreases the probability of producing inaccurate financial statements. Data enable you to make proper decisions and ensure that all financial transactions are straightforward.

- Better Financial Control

Tracking and reporting facilities are compelling, and they allow you to exercise better control over your financial situation. This control is especially beneficial for recognising opportunities for spending improvement and efficient budget allocation.

- Streamlined Operations

Completing a payment or managing your expenses with the integration of payment gateways and other expense management systems. This approach is rather sophisticated in terms of reducing the amount of work done manually while improving overall productivity.

- Informed Decision-Making

Real-time information and flexible analytical tools would be helpful in managing your financial situation. Overall, this information can enhance the quality of decisions and strategic solutions.

Modules of Accounting Software for Travel Agency

With approximately 75% of bookings made online and a fast and constantly changing travel market, it is crucial to have a stable, user-friendly, and sophisticated back-end solution that organises day-to-day work. As everyone knows, accounting and finance are essential components of an organisation, and an efficient package of accounting software for travel agency is vital to speed up, enhance, and efficiently perform the organisation’s accounting functions.

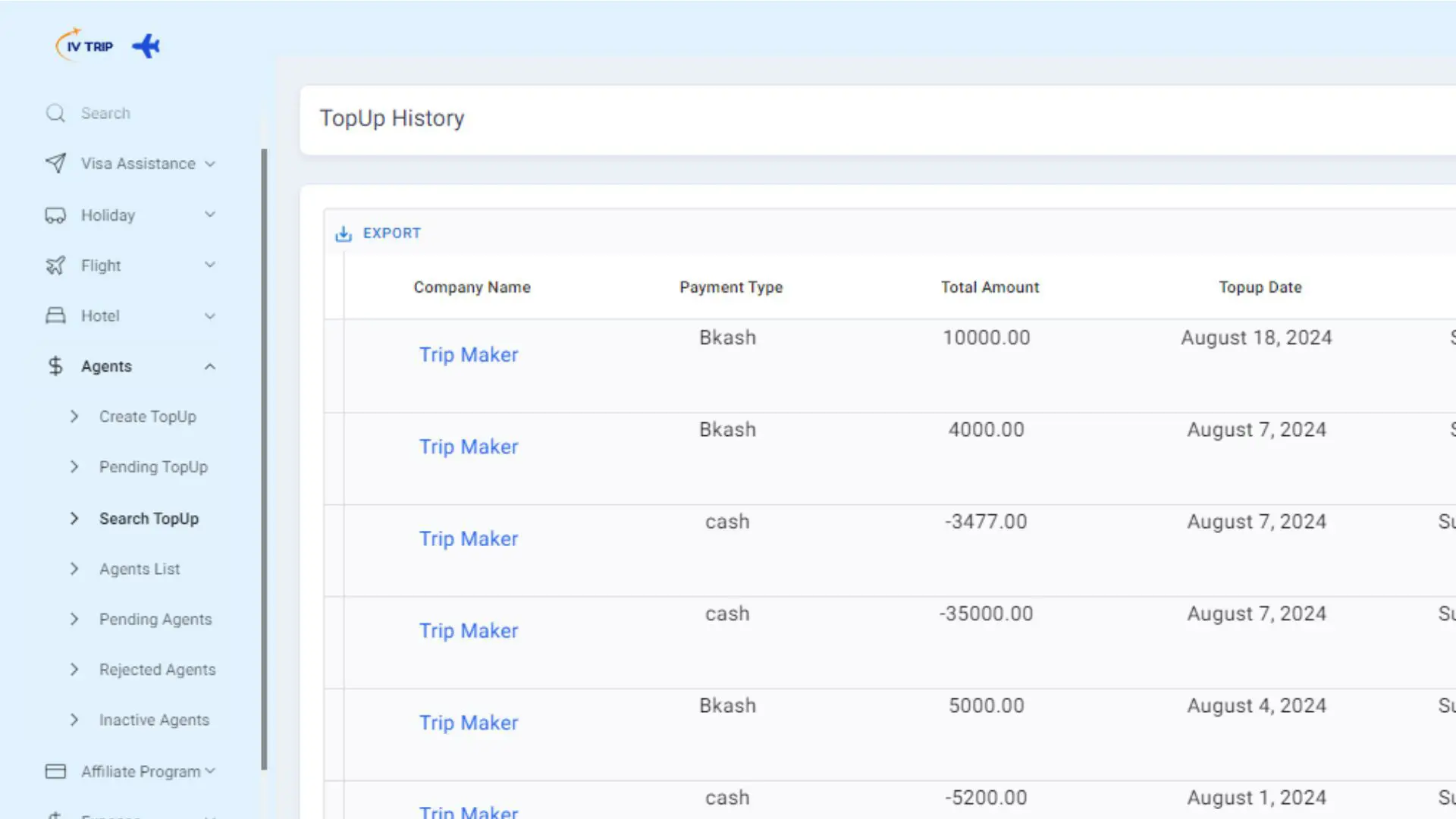

IV Trip’s accounting feature of travel agency software, a back office solution encompassing IATA agents, non-IATA agents, GSA agents, and tour operator agents, is a popular and indispensable tool that allows travel agents to perform accounting, billing, payable accommodation, settling, receivables tracking, processing, and expenses and recovery maintenance.

The vital feature offers them security and role-controlled access privileges and enables the setting of business rules such as customers, vendors, taxes, and incentive policies.

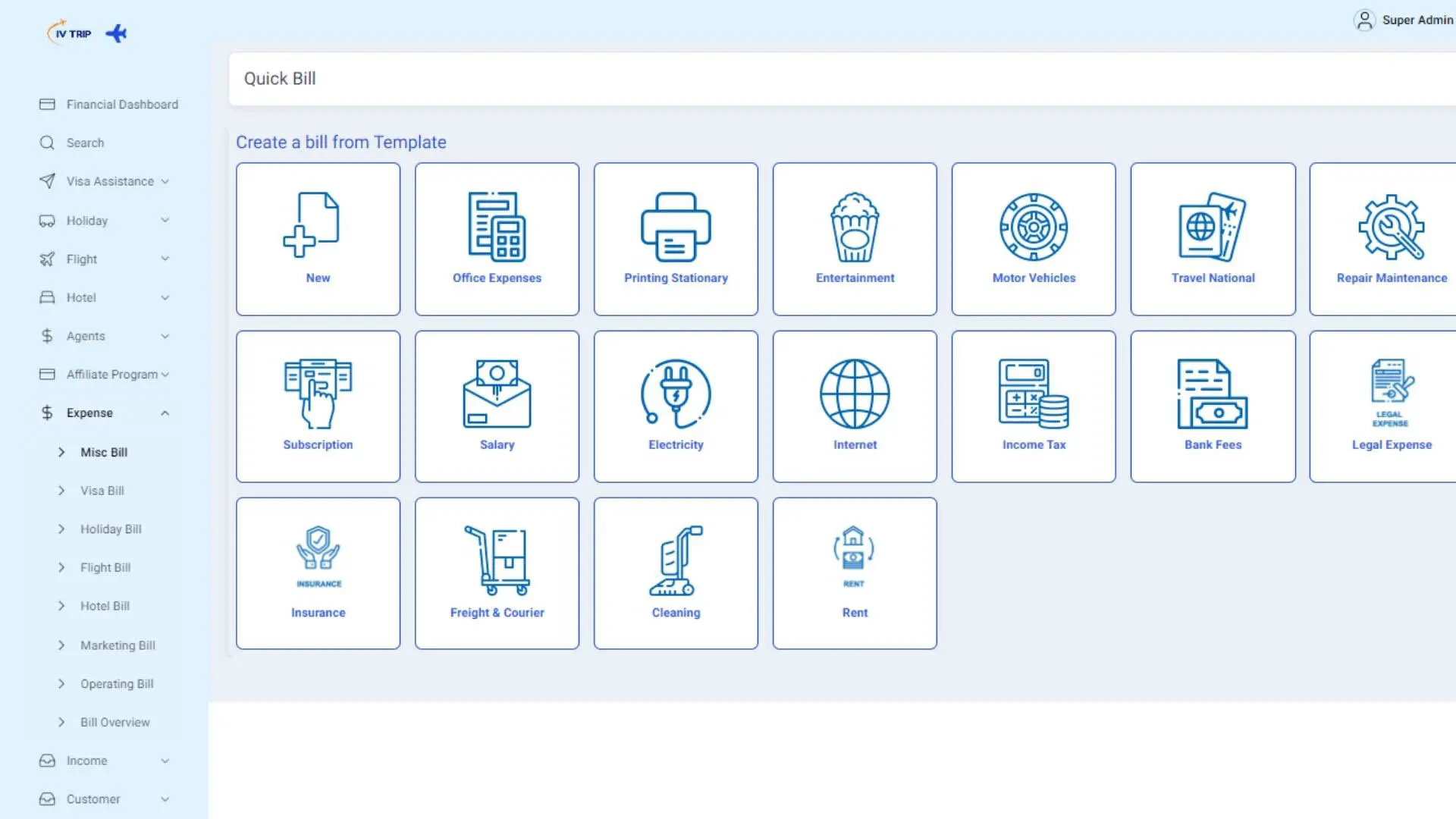

Significant Modules of Accounting Features by IV Trip:

Air Ticketing Module

Flight Inventory Module

Visa Assistance Module

Hotel Booking Module

Holiday Packages Module

Solutions: Manage all travel accounting in a simple & easy way

IV Trip can help enhance communication with a travel agency customer, decreasing loyalty and pushing up sales. IV Trip is designed for companies that want to avoid investing big money in commercial industry solutions and want a cheap and easily adaptable solution that can be easily adapted to the company’s business processes.

Receivables Tracking

![]()

– Manage and monitor all your receivables effectively.

– Set due dates and automate payment reminders for customers.

– Use filters like date, month, and payment status to categorise your receivables.

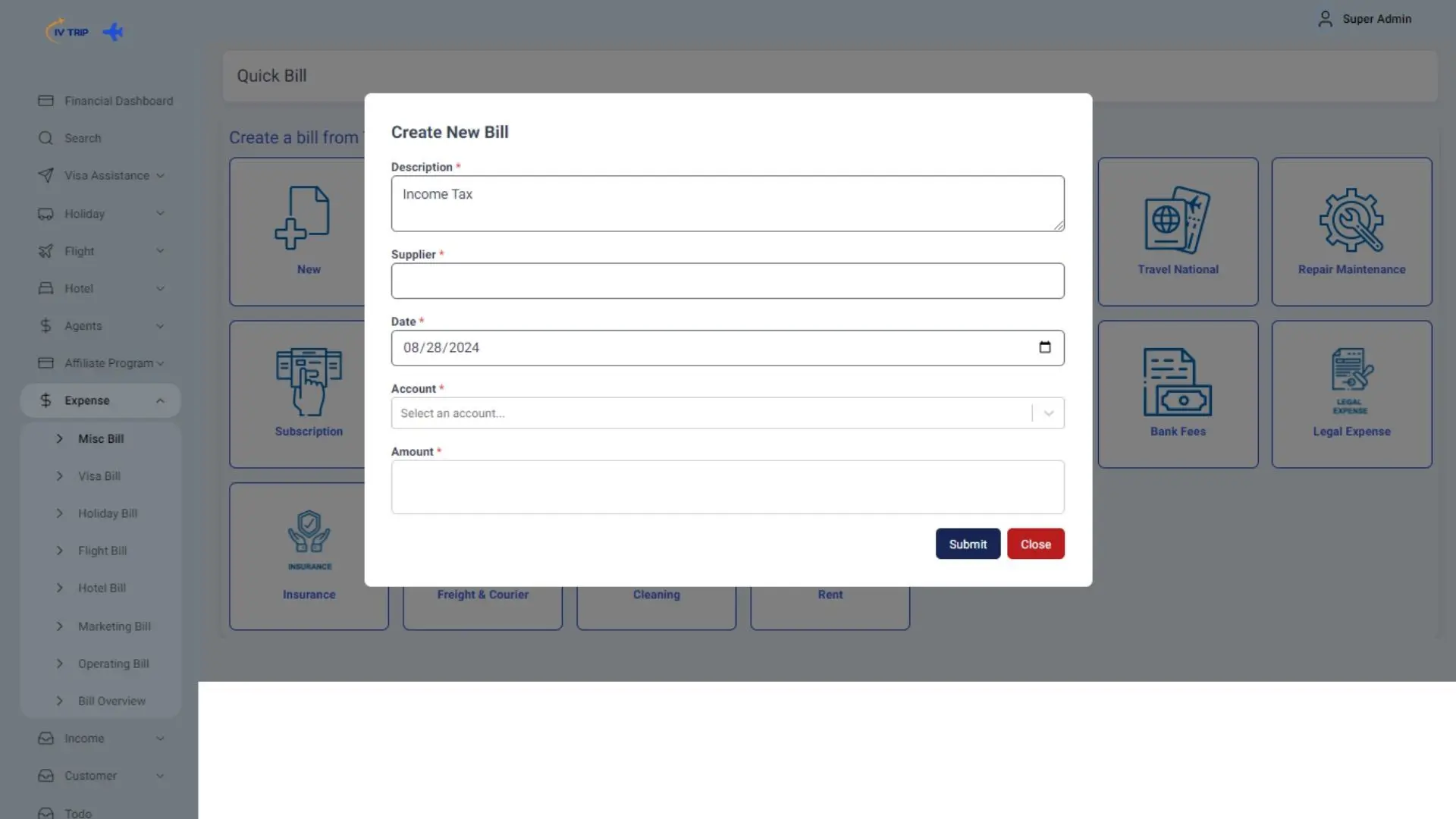

Expense Overview

– Track all business expenses and sort them into relevant categories.

– Visualize expenses with a pie chart for better insight.

– Access detailed reports by date, month, and quarter.

Profit Analysis

– Review income and expenses for each trip.

– Generate profit reports based on specific bookings.

– Track and analyse profits by individual employees.

Cash Flow Comparison

– Compare receivables and payments clearly.

– Obtain reports on a weekly, monthly, or quarterly basis using date filters.

– View a bar graph to highlight cash flow trends for selected date ranges.

Key Features of IV Trip’s Accounting Software

IV Trip is cloud-based accounting software developed for all types of business enterprises, particularly travel agencies. It is far advanced from basic accounting since it manages purchase orders, multiple companies, and users. In an industry where 40% of respondents reported facing financial issues, including invoicing and payments, IV Trip is designed to help with invoicing and customer relationships.

Especially designed for travel agencies, IV Trip is a tool that can unite reservations, invoices, and commission systems. Since 70% of travel agencies have commission structure issues, IV Trip solves this problem through the effective management of different commission rates and shared commissions among agents. This appropriate tool also helps record financial transactions correctly and manage revenues for travel businesses.

– Manage all accounting activities through an interactive dashboard that offers a user-friendly experience.

– The interface is designed to be intuitive, making it easy to navigate and use.

– Features are extensive and provide in-depth functionality for various accounting needs.

– Integrates smoothly with many popular services for added convenience.

– Access your accounting information in real-time for up-to-date insights.

– Operate both online and offline with robust web-based back-office operations.

– Connect with your booking engine through the available API integration.

– Supports a range of booking systems, including flights, hotels, car rentals, transfers, and cruises, as well as both static and dynamic packages.

– ARC/BSP, PLB, taxes, and currencies are integrated from the start, not as additional add-ons.

– Complete Accounts Receivable (AR) and Accounts Payable (AP) functionalities are available, including partial payment transactions.

– Reports can be saved, printed, or emailed in PDF and Excel formats.

– Allows for individual billing of different products.

– Supports processing for single or multiple companies.

– Customize series for invoices, credit notes, and receipts as needed.

– An audit log tracks all transactional and modification activities.

– Fare, tariff, and charge calculations are automated during invoice creation.

– Transactions are automatically tracked for seamless management.

Frequently Asked Questions

What is it about accounting software for travel agency that gives them so many advantages?

They include improving efficiency, precision, control over finances, simplification of working processes, and effective decision-making.

How does IV Trip’s software automate financial tracking?

It simplifies the process of capturing all the transactions related to bookings, cancellations, refunds, and attendant paperwork.

Can IV Trip’s software handle transactions in multiple currencies?

Yes, it accommodates multiple currencies and offers proper currency conversion and reporting.

What types of financial reports can be generated with IV Trip’s software?

The software allows for customisable reports, including financial statements, expense breakdowns, and budget forecasts.

In what ways does IV Trip’s software help as far as tax issues are concerned?

It automates tax calculations and generates reports needed for tax filing, simplifying compliance with tax regulations.

Does IV Trip’s software integrate with payment gateways?

Yes, it integrates with different payment gateways to ensure the secure, fast, and effective completion of deals.

What is the value of providing real-time reporting of the company’s financial status?

Real-time reporting allows current information to serve the control and decision-making needs and reveal tendencies in financials.

Is the financial data safe with IV Trip using its software?

Yes, the software requires the encryption of financial data and the restriction of access to the data.

How does automated invoicing work in IV Trip’s software?

It enables the creation of attractive invoices and statements, the monitoring of payments, and the status of bills that are unpaid or past due.

What support is available for new users of IV Trip’s software?

IV Trip also provides the new user with manuals, lessons, and customer care to assist the new user in adjusting to the software.

In this cutthroat travel industry, having top-notch accounting software for travel agency is a must. IV Trip’s travel agency software comes with a comprehensive range of features designed to streamline financial management. From automatic transaction tracking to real-time reporting and effortless tax compliance, our software makes managing your agency’s finances both straightforward and efficient.

With IV Trip, you can keep a close eye on your financial health, enhance decision-making, and ensure your business operates smoothly and profitably.